Online GST Registration

Registration of any business entity under the GST Law implies obtaining a unique number from the concerned tax authorities to collect tax on behalf of the government and avail Input tax credit for the taxes on his inward supplies.

- Quick & Easy

- 100% Accuracy

- Get Expert Advice

- Complete services under one roof

GST REGISTRATION

Online GST Registration is the process of obtaining a unique identification number by a supplier from the tax authorities; it is for the identification of the taxpayer. Every supplier/business with a turnover of Rs 40 lakhs or more (Rs 10 lakhs for special category states) needs to be registered under GST. The supplier shall be allotted a 15-digit GSTIN (GST identification number) and a certificate of registration by the GST department. SUPER CA helps you to get your GST REGISTRATION done within 4–6 working days at the lowest prices. Let us make it easy for you.

WHO SHOULD REGISTER UNDER GST?

TURNOVER LIMIT (SEC 22)

Businesses engaged in the supply of goods having a turnover of Rs 40 lakhs or more (10 lakhs if the business is in Assam, Himachal Pradesh, Uttarakhand, Arunachal Pradesh, Manipur, Mizoram, Sikkim, and Nagaland) are required to get registered under GST.

Service providers having a turnover of Rs 20 lakhs or more (10 lakhs if a business is in Assam, Himachal Pradesh, Uttarakhand, Arunachal Pradesh, Manipur, Mizoram, Sikkim, and Nagaland) are required to get registered under GST.

COMPULSORY GST REGISTRATION (SEC 24)

- Entity/person making Interstate Taxable supply.

- Casual Taxable persons making Taxable supply.

- Non-Resident Taxable persons making Taxable supply.

- Input Service Distributor.

- Every Electronic commerce operator.

- Supplier of OIDAR (online information and database access or retrieval services) from outside India to a person in India, other than a registered taxable person.

- Agent of a supplier (Person making supply on behalf of a taxable person)

- Persons required paying tax under Reverse Charge Scheme.

- TDS Deductor.

VOLUNTARY REGISTRATION (SEC 25)

A Person engaged in the supply of taxable goods and services can get registered voluntarily even if he does not qualify for compulsory registration or does not cross the specified turnover.

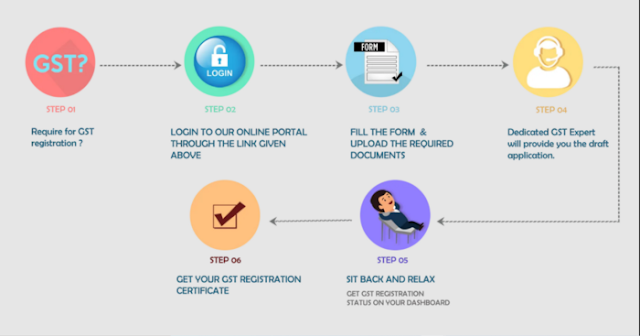

How to apply for online GST Registration

ADVANTAGES

LEGAL RECOGNITION

The Individual/businesses shall be legally recognized as a Supplier of Goods & Services.

INPUT TAX CREDIT CLAIM

A registered person can claim the Input tax credit (tax paid on the purchase of goods & services).

TRANSFER OF INPUT TAX CREDIT

A registered person can pass on the credit of the taxes paid on the supply of the goods & services to the purchaser.

INTERSTATE SUPPLY

He can make Interstate sales without restrictions.

COMPETITIVE ADVANTAGE

He can have a competitive advantage in comparison to other businesses Small businesses (having turnover of less than 1 crore) can opt for a composition scheme to lower their taxes.

LESS COMPLIANCE

In GST, the number of compliances is less as it has replaced all other indirect taxes.

WHAT WE OFFER

GST REGISTRATION Fee: ₹ 999 PLUS TAXES(18%)

- GST REGISTRATION CERTIFICATE

- E-WAY BILL PORTAL REGISTRATION

- GST INVOICING FORMATS

- 3 MONTHS RETURN FILING

- CURRENT ACCOUNT OPENING SUPPORT

- SUPPORT REGARDING GST RATES/HSN

- DEDICATED GST & E-WAY BILL EXPERT FOR FIRST 3 MONTHS

- ₹ 999/- PLUS GST

Comments

Post a Comment