All about GST Compliance Calendar

ST due dates are very important for every taxpayer not only for sake of filing GST returns and prescribed forms under the GST law timely but also to avoid incurring any interest or late fee.

It is also important for businesses and entrepreneurs to stay compliant with various compliance throughout the year. Every month is significant, as far as GST compliance is concerned. There are various tax and statutory compliance that includes the due dates relating to GST return filing that fall in the month of August 2021.

Regular compliances and procedures are required to be followed by those coming under its ambit. In all those, return related compliance is one of the most important things in compliance under the GST. The GST registered dealer has to file a statement of the transactions of the business i.e. returns on a monthly/quarterly/annual basis.

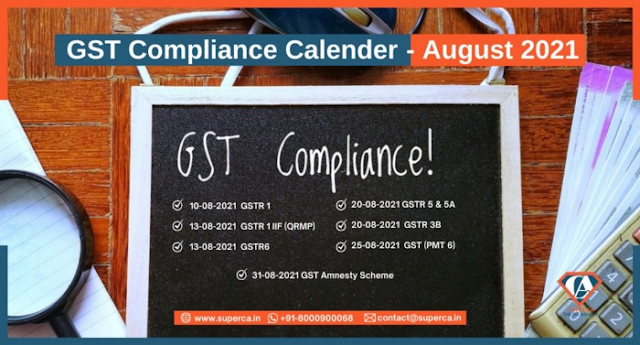

Various due dates for the GST Returns in the Month of August 2021

Cessation

Once you follow all the GST compliance checklists, you will be able to conduct the business smoothly without any issues and concerns. GST laws will not just reform your taxation but affect almost every aspect of your business operations. As a registered person, it is important to understand GST, its implications, and to adopt a robust system that will help alleviate GST compliance worries.

As far as compliances are concerned, August 2021 is a crucial month for the due dates for various compliances, not only under the Goods and Service Tax but also for Income Tax Act, Companies and LLP Act. Taxpayers should ensure the filing of the above-mentioned forms on or before the due dates in order to save themselves from hefty penalties.

Originally published at https://superca.in on Aug 19, 2021.

Comments

Post a Comment